myBSN & BSNSecure SECURITY ENHANCEMENT

To safeguard your online banking experience, these security features will be implemented starting 29 June 2024:

myBSN Internet Banking

- A 12-hour cooling-off period is activated when you increase your third-party transaction limit.

BSNSecure

- First-time BSNSecure enrollment on a customer’s device or upon change of device will require activation via BSN Contact Centre or BSN Branch.

- BSNSecure authentication is required for the following transactions:

- Transfer to your own BSN account(s) and payments to your credit card & financing RM10,000 and above.

- Savings of BSN SSP / SSP Platinum RM10,000 and above via myBSN Internet Banking.

IMPORTANT NOTES:

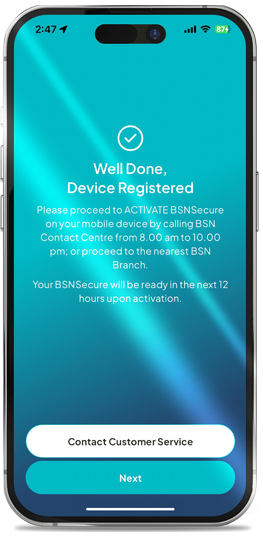

Upon successful BSNSecure registration, customers can only perform myBSN transactions after 12 hours (Cooling-off Period). This provides enhanced customers protection and prevents unauthorised transactions.

Activate BSNSecure function on myBSN Mobile App for safer and seamless myBSN transaction authorisation

BSNSecure is an enhanced online security feature for myBSN Internet Banking & myBSN Mobile App.

The BSNSecure function allows you to authorise your myBSN transactions safely and seamlessly.

Once you have registered and activated the BSNSecure function as a mode of authorisation, this will be the default method for approving ALL your myBSN Internet Banking transactions, replacing the SMS TAC that has be ceased effective 1 July 2023.

BENEFITS OF BSNSecure

- An easier and safer way to authorise myBSN transactions.

- Authentication through customer-registered devices.

- Avoid being exposed to SMS TAC fraud.

- No need to wait for SMS TAC to authorise myBSN transaction.

HOW TO AUTHORISE myBSN INTERNET BANKING TRANSACTIONS WITH BSNSecure?

Secure Verification

A Push Notification alert will be sent to your myBSN Mobile App to authorise myBSN transactions. You are required to tap on the notification to Approve or Reject the transaction within 60 seconds. Note: Secure Verification (Push Notification) will be the default mode to approve all your myBSN transactions. |

Secure TAC

Note: The number will appear and refresh every 60 seconds. |

HOW TO REGISTER BSNSecure APPLICATION? (Registration & Activation)

Please click on the number below to see the screenshot of each of the following steps.

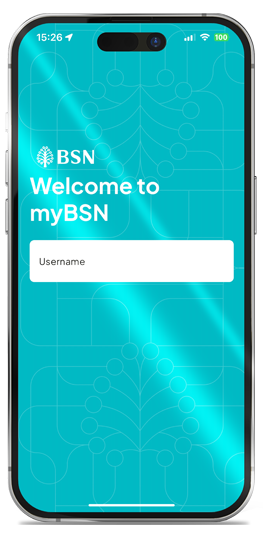

Launch the myBSN Mobile App upon successfully downloading and tap the “Get Started” button.

Proceed to enter myBSN Username and Password.

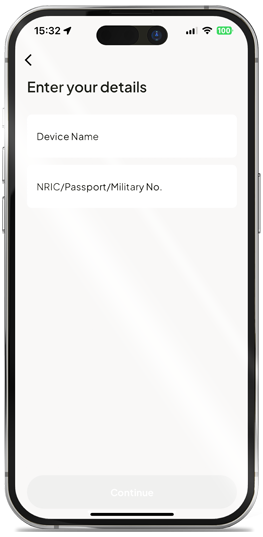

Insert Device Name, ID number & click Submit to confirm.

- Device Name/Phone Model: (Example: iPhone 14 Pro/ Galaxy S23 Ultra/ Huawei P60 Pro).

- ID Number/Identification Card Number: (Example: 95131314***).

Upon successful registration, an acknowledgement screen will be shown to you on screen.

Next, activate your BSNSecure at BSN Contact Centre or Branch.

Type of Transaction required BSNSecure

| Types of Transactions | Type of Authentication | |||

| NA | BSNSecure | SMS OTP / TAC | ||

| Login to myBSN Internet Banking | ✔️ | |||

| View Account Balance & Transaction History | ✔️ | |||

| E-Statement Download | ✔️ | |||

| e-SSP / e-SSP Platinum Savings Note: Transactions above RM10,000 on myBSN channel. | ✔️ | |||

Payment / Transfers to own accounts:

Note: Transactions above RM10,000 on myBSN channel. | ✔️ | |||

| Own Account Transfer & Payment (includes BSN Credit Card & Financing) | ✔️ | |||

| e-SSP Savings | ✔️ | |||

Debit Card

| ✔️ | |||

| Adding New Favorites (3rd Party Account, DuitNow Transfer, JomPAY) | ✔️ | |||

| NAD (DuitNow) Settings | ✔️ | |||

| Other Account Maintenance | ✔️ | |||

| Favorite Transfer & Payment | ✔️ | |||

| Open Transfer (DuitNow, 3rd party Account Transfer) | ✔️ | |||

| Open Payment (JomPAY, Billers, Prepaid Top-up, U-Pin Purchase, 3rd party Credit Card / Financing, FPX) | ✔️ | |||

| Recurring (Standing Instruction) | ✔️ | |||

Account Setting (myBSN)

| ✔️ | |||

Future Transfer & Recurring (SI)

| ✔️ | |||

| Safe Switch | ✔️ | |||

| Credit Card PIN Request / Change | ✔️ | |||

| Forgot Password | ✔️ | |||

| myBSN Internet Banking registration | ✔️ | |||