Regardless of what your dreams and goals may be, proactive planning is essential.

WHAT DOES BSN TAKAFUL MAKMUR OFFER?

- Flexibility

Allows you to choose your preferred contribution payment term of 3 years or 5 years, according to your affordability and financial needs.

- Annual Cash Payout (ACP)

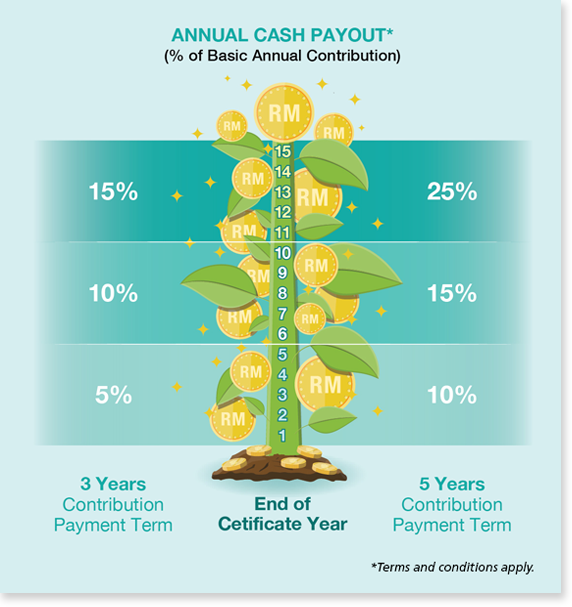

Receive an increasing trend of the ACP from the end of the first certificate year and annually until the certificate matures. You may decide to utilise or reinvest your ACP with PruBSN.

- Potential Upside Returns

You have the option to invest in our wide range of Takafulink funds for potential investment gains from Investment Unit Account (IUA), when you attach Takaful Saver or accumulate your ACP in the IUA.

- Comprehensive Add-On Protection

- You may choose to add any of the Optional Riders to suit your needs.

- For more details of Optional Riders, please refer to the Product Features below.

- Life Coverage

- You and your family will be financially protected in the event that Total and Permanent Disability (TPD) or your untimely demise.

- In the event of your death due to accident, an additional Basic Sum Covered will be payable on top of death benefit.

Notes:

- TPD/Accidental Death Benefit is up to age 70 next birthday.

- Please refer to the Product Features below for more details on the benefits payout.

- Maturity Payout

Receive the higher of Maturity Benefit equivalent to Basic Sum Covered or the amount in MaxiShield Account (MSA), with amount in IUA (if any) upon maturity of the certificate.

Note: Maturity benefit is only payable provided you have paid all your contributions in full within the contribution grace period. Otherwise, only amounts in MSA and value of units in IUA (if any) at the valuation date after the date of maturity will be payable at maturity of the certificate.

- Guaranteed Acceptance

Easy application and no medical check-up is required with Guaranteed Issuance Offer (GIO)*.

*Guaranteed Issuance Offer (GIO) for Basic Sum Covered up to RM300,000 (per life basis). Applicable to basic plan without attachment of rider(s) (except for Takaful Saver).

“With this comprehensive protection, it not only ensures that you are protected but also brings you one step closer to realising your savings objectives”

BASIC COVERAGE

| Entry Age | 3 Years CPT: 14 days old - 50 years next birthday 5 Years CPT: 14 days old - 55 years next birthday | ||||||||||||||

| Contribution Payment Term (CPT) | 3 or 5 years | ||||||||||||||

| Basic Sum Covered | 3 Years CPT: 170% of Basic Annual Contribution 5 Years CPT: 280% of Basic Annual Contribution | ||||||||||||||

| Coverage Term | 15 years | ||||||||||||||

| Contribution | Allows you to choose your contributions according to your affordability and financial needs as low as RM3,600 annually for 5 Years CPT and RM6,000 annually for 3 Years CPT. | ||||||||||||||

| Death or Total Permanent Disability (TPD) Benefit | In the event of death or TPD1 of the Covered Person before expiry of the coverage term, PruBSN will pay a higher of:

1 TPD coverage is up to the certificate anniversary date of the Covered Person attains age 70 years next birthday or expiry of the coverage term, whichever is earlier. 2 For first 2 certificate years: 100% of total basic contribution paid (inclusive of Wakalah Certificate Charge) - Total ACP paid; From 3rd certificate year and onwards: 105% of total basic contribution paid (inclusive of Wakalah Certificate Charge) - Total ACP paid. | ||||||||||||||

| Accidental Death Benefit | In the event of death of the Covered Person caused by accident before the certificate anniversary date of the Covered Person attains age 70 years next birthday or expiry of the coverage term, whichever is earlier, PruBSN will pay additional 100% of Basic Sum Covered on top of Death Benefit payment. | ||||||||||||||

| Annual Cash Payout (ACP) | Receive an increasing ACP annually starting from the end of first certificate year until the maturity of the certificate. You can decide to utilise or reinvest your ACP with PruBSN.

| ||||||||||||||

| Maturity Benefit | Receive the higher of Maturity Benefit equivalent to Basic Sum Covered or the amount in MaxiShield Account (MSA), with amount in IUA (if any) upon maturity of certificate. Note: Maturity Benefit only payable provided you have paid all your contributions in full within the contribution grace period. Otherwise, only amounts in MSA and value of units in IUA (if any) at the valuation date after the date of maturity will be payable at maturity of the certificate. | ||||||||||||||

| Optional Riders | Customise your protection with the optional riders below:

| ||||||||||||||

NOTES:

- This product is shariah-compliant.

- This product is guaranteed by PruBSN and distributed by BSN.

- For more info, kindly talk to us at your nearest BSN Branch.

- View Takaful Service Guide.

- View Product Disclosure Sheet.

- Download e-Brochure.

- Terms & Conditions apply.