Tidak kira apa impian dan matlamat anda, perancangan yang proaktif adalah sangat penting.

APA YANG BSN TAKAFUL MAKMUR TAWARKAN?

- Fleksibiliti

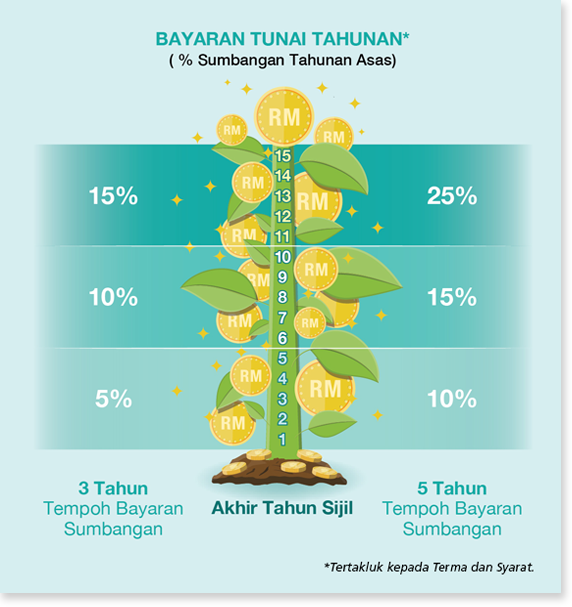

Anda boleh memilih jangka masa pembayaran sumbangan antara 3 tahun atau 5 tahun, mengikut kemampuan dan keperluan kewangan anda.

- Bayaran Tunai Tahunan (ACP)

Anda akan menerima trend peningkatan ACP setiap tahun bermula dari akhir tahun sijil pertama sehingga sijil matang. Anda boleh pilih untuk menggunakan atau melabur semula ACP anda bersama PruBSN.

- Potensi Pulangan Terbaik

Anda mempunyai pilihan untuk melabur dalam pelbagai dana Takafulink PruBSN untuk potensi keuntungan pelaburan dari Akaun Unit Pelaburan (IUA), apabila anda melampirkan Takaful Saver atau mengumpulkan ACP dalam IUA.

- Perlindungan Tambahan Komprehensif

- Anda boleh memilih untuk menambah mana-mana Rider Pilihan untuk memenuhi keperluan anda.

- Untuk butiran lanjut tentang Rider Pilihan, sila rujuk Ciri-ciri Produk di bawah.

- Perlindungan Hayat

- Anda dan keluarga anda akan dilindungi dari segi kewangan sekiranya berlaku Hilang Upaya Kekal & Menyeluruh (TPD) atau kematian berlaku terhadap anda.

- Sekiranya kematian anda disebabkan oleh kemalangan, Jumlah Perlindungan Asas akan dibayar sebagai tambahan kepada manfaat kematian.

Nota:

- Manfaat TPD/Kematian Akibat Kemalangan adalah sehingga umur 70 tahun pada hari jadi berikutnya.

- Sila rujuk kepada Ciri-ciri Produk di bawah untuk butiran lanjut tentang pembayaran manfaat-manfaat.

- Pembayaran pada sijil matang

Anda akan merima Manfaat Matang yang lebih tinggi bersamaan dengan Jumlah Perlindungan Asas atau jumlah dalam Akaun MaxiShield (MSA), bersama dengan jumlah dalam IUA (jika ada) apabila sijil matang.

Nota: Manfaat matang hanya dibayar dengan syarat anda telah membayar sumbangan anda sepenuhnya dalam tempoh penangguhan sumbangan. Jika tidak, hanya amaun dalam MSA dan nilai tunai dalam IUA (jika ada) pada tarikh penilaian selepas tarikh matang akan dibayar pada tarikh sijil matang.

- Permohonan mudah tanpa pemeriksaan perubatan

Permohonan yang mudah dan tiada pemeriksaan perubatan diperlukan dengan Tawaran Pemberian Dijamin (GIO).

Nota: Tertakluk kepada terma dan syarat, Tawaran Pemberian Dijamin (GIO) boleh diberikan untuk Jumlah Perlindungan Asas sehingga RM300,000 (setiap hayat). Terpakai kepada pelan asas tanpa lampiran rider (kecuali Takaful Saver).

“Perlindungan menyeluruh ini bukan sahaja memastikan anda dilindungi, tetapi juga membawa anda selangkah lebih dekat dengan matlamat simpanan anda.”

PERLINDUNGAN ASAS

| Umur Kemasukan | 3 Tahun CPT: berumur 14 hari - umur 50 tahun pada hari jadi berikutnya 5 Tahun CPT: berumur 14 hari - umur 55 tahun pada hari jadi berikutnya | ||||||||||||||

| Tempoh Bayaran Sumbangn (CPT) | 3 atau 5 tahun | ||||||||||||||

| Jumlah Perlindungan Asas | 3 Tahun CPT: 170% daripada sumbangan asas tahunan 5 Tahun CPT: 280% daripada sumbangan asas tahunan | ||||||||||||||

| Tempoh Perlindungan | 15 tahun | ||||||||||||||

| Sumbangan | Anda boleh memilih jumlah sumbangan mengikut kemampuan dan keperluan kewangan anda, dari serendah RM3,600 setahun untuk 5 Tahun CPT dan RM6,000 setahun untuk 3 Tahun CPT. | ||||||||||||||

| Manfaat Kematian atau Hilang Upaya Kekal & Menyeluruh (TPD) | Sekiranya berlaku kematian atau TPD1 terhadap Orang yang Dilindungi sebelum tamat tempoh perlindungan, PruBSN akan membayar jumlah yang lebih tinggi antara:

1 Perlindungan TPD berkuat kuasa sehingga tarikh ulang tahun sijil apabila Orang Yang Dilindungi mencapai umur 70 tahun pada hari jadi berikutnya atau tamat tempoh perlindungan, yang mana lebih awal. 2 Untuk 2 tahun pertama sijil: 100% daripada jumlah sumbangan asas yang dibayar (termasuk Caj Sijil Wakalah) - Jumlah keseluruhan ACP yang dibayar; Dari tahun sijil ke-3 dan seterusnya: 105% daripada jumlah sumbangan asas yang dibayar (termasuk Caj Sijil Wakalah) - Jumlah keseluruhan ACP yang dibayar. | ||||||||||||||

| Manfaat Kematian Kemalangan | Sekiranya berlaku kematian terhadap Orang Yang Dilindungi disebabkan oleh kemalangan sebelum tarikh ulang tahun sijil Orang Yang Dilindungi mencapai umur 70 tahun pada hari jadi berikutnya atau tamat tempoh perlindungan, yang mana lebih awal, PruBSN akan membayar tambahan 100% daripada Jumlah Perlindungan Asas di atas pembayaran Manfaat Kematian. | ||||||||||||||

| Bayaran Tunai Tahunan (ACP) | Anda akan menerima trend peningkatan ACP setiap tahun bermula dari akhir tahun sijil pertama sehingga tempoh sijil matang. Anda boleh memutuskan untuk menggunakan atau melabur semula ACP anda dengan PruBSN.

| ||||||||||||||

| Manfaat Matang | Anda akan merima Manfaat Matang yang lebih tinggi bersamaan dengan Jumlah Perlindungan Asas atau jumlah dalam Akaun MaxiShield (MSA), bersama dengan jumlah dalam IUA (jika ada) apabila sijil matang. Nota: Manfaat Matang hanya dibayar jika anda telah membayar sumbangan anda sepenuhnya dalam tempoh penangguhan sumbangan. Jika tidak, hanya amaun dalam MSA dan nilai unit dalam IUA (jika ada) pada tarikh penilaian selepas tarikh matang yang akan dibayar pada waktu sijil matang. | ||||||||||||||

| Rider Pilihan | Ubahsuai perlindungan anda dengan pilihan rider-rider berikut:

| ||||||||||||||

NOTA:

- Produk ini adalah produk patuh syariah.

- Produk ini dijamin oleh PruBSN dan diedarkan oleh BSN.

- Untuk maklumat lanjut, sila hubungi Cawangan BSN berhampiran anda.

- Lihat Panduan Perkhidmatan Takaful.

- Lihat Penyata Pendedahan Produk.

- Muat turun e-Brosur.

- Tertakluk kepada Terma & Syarat.

BERHUBUNG DENGAN KAMI

Kunjungi cawangan kami

Kunjungi cawangan kami yang terdekat atau hubungi kami untuk maklumat lanjut